Fast international payments are the lifeblood of modern tech and SaaS companies. Despite this, many organizations still operate on outdated assumptions about cross-border transactions. These myths create friction, slow down cash flow, and hinder expansion. In a landscape where most of of business applications are predicted to be SaaS-based by 2025 , clinging to these misconceptions is a luxury no company can afford.

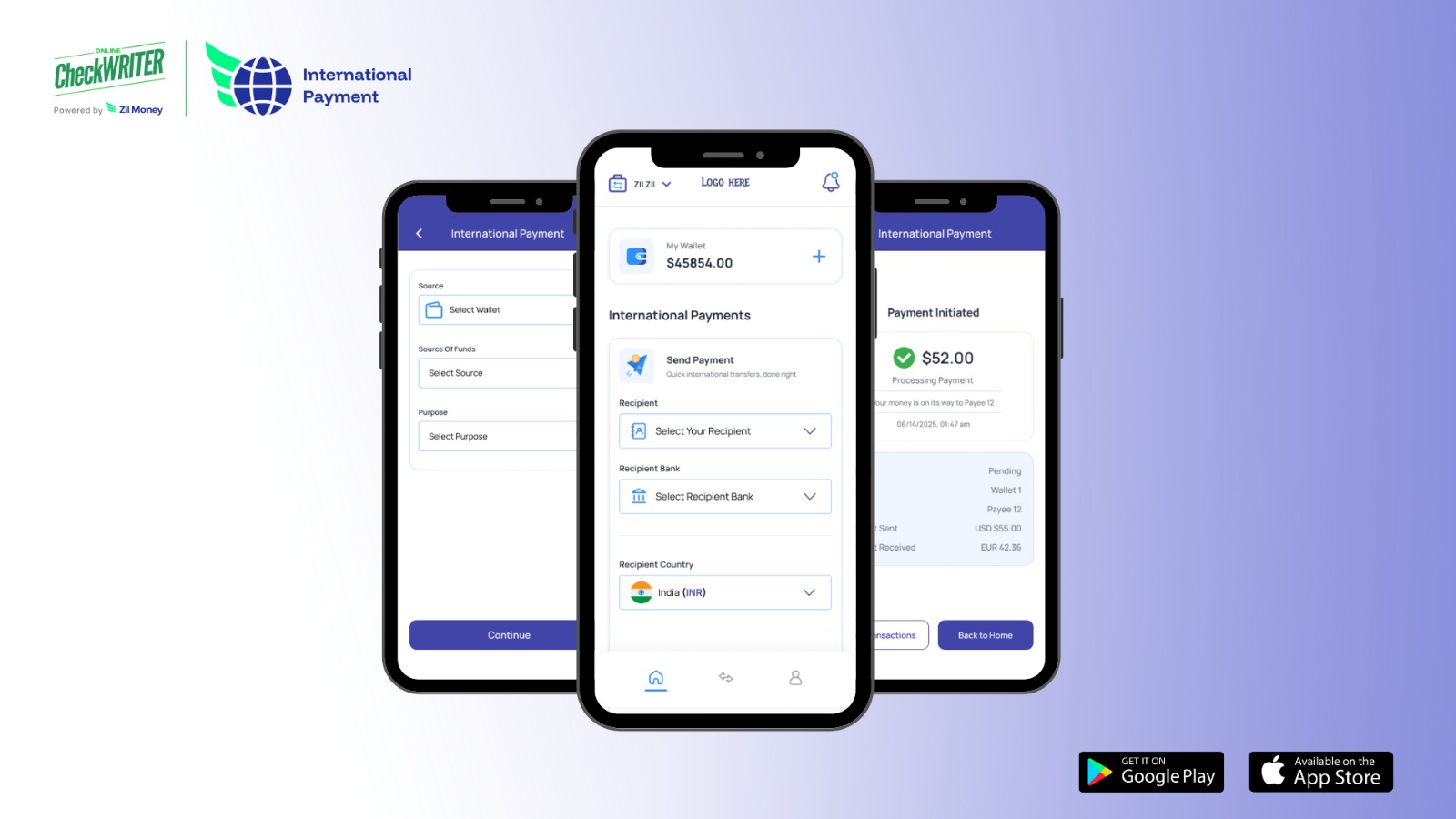

Here, we debunk the five most persistent myths about international payments and introduce a modern solution: the OnlineCheckWriter.com – Powered by Zil Money mobile app.

Reality: In the fast-paced SaaS sector, time is critical. Predictable MRR and smooth project pipelines depend on timely receipt of funds. The traditional three-to-five-day settlement period is outdated, while fintech innovations are compressing payment processing times from days to minutes.

The new app from OnlineCheckWriter.com - Powered by Zil Money is engineered for this new reality. It ensures international transfers are executed with the speed the digital economy demands. Vendors are paid promptly, customer accounts remain active, and finance teams are spared from chasing payments. For SaaS providers, this means predictable subscription cycles, stable revenue, and sustained investor confidence.

Reality: Unexpected deductions and opaque fee structures wreak havoc on financial forecasts, distorting ARR calculations and eroding trust with partners and customers. With non-traditional payment providers now handling 65% of the value of international P2P transfers, transparency has become a powerful competitive advantage.

The app provides absolute clarity. The amount you send is the amount that arrives. By eliminating the "mystery math" of legacy systems, it protects your global revenue and ensure financial planning is built on certainty.

Reality: Juggling different providers for wires, ACH, and vendor payouts is inefficient and risky. Recognizing these challenges, the G20 has established a roadmap to enhance cross-border payments by 2027, focusing on reducing costs, increasing speed, and improving transparency.

The new app offers a unified solution. It consolidates ACH, wires, checks, and virtual cards into one platform. This eliminates managing multiple dashboards, simplifies reconciliation, and reduces integration burden.

Reality: Automation is the engine of the SaaS industry. When a customer makes a payment, the billing API should instantly trigger a cascade of actions—from subscription renewal to continued service access. Legacy systems often break this flow, forcing manual interventions.

The app is API-friendly, enabling seamless, event-driven workflows. Payment confirmation can be linked directly to your billing, onboarding, and vendor management systems, eliminating friction and reducing churn.

Reality: Not long ago, managing international payments was complex and costly, seemingly reserved for large corporations with finance teams. The rise of accessible fintech solutions has leveled the playing field.

The new app from OnlineCheckWriter.com - Powered by Zil Money is mobile-first and built for ease of use. From lean startups to established enterprises, any organization can manage cross-border transfers with confidence. The app has made global growth achievable for every tech firm.

SaaS platforms are built on immediacy. Subscriptions renew on schedule, features are deployed continuously, and integrations are triggered in real time. Your payment processes should operate with the same velocity and precision.

In 2025, treating international payments as a secondary concern is a strategic error. Companies that fail to adapt will face stalled growth, dissatisfied customers, and frustrated investors. Those that embrace modern, transparent, and integrated payment solutions will unlock opportunities and build competitive advantage.

This is the value that OnlineCheckWriter.com – Powered by Zil Money delivers: faster transactions, clarity, predictability, and flexibility to thrive in the global digital economy.

Your SaaS product is designed for speed. Your payments should be too.

Download the app now from App Store or Google Play Store and eliminate friction from international transfers.

Q1: Why are fast international payments critical for SaaS providers?

Because delays directly impact MRR, churn rates, and investor confidence. Instant settlement keeps revenue predictable, and customers engaged.

Q2: Does the app support API-driven workflows?

Yes. It’s built for seamless integrations, so billing, provisioning, and vendor workflows stay in sync with payments.

Q3: Is a hidden fee required?

No, not at all. The app requires no hidden fee or pre-funding