Vehicle rentals are a convenient option for travel, business, or temporary transportation. But what happens if you get into an accident while driving a rental vehicle? Many people wonder who is responsible, whether they can file a personal injury lawsuit, and who pays for damages.

Understanding the legal and insurance landscape in these situations is crucial to protect your rights and finances.

Who Is Liable in a Rental Car Accident?

Liability in rental car accidents depends on several factors, including the terms of the rental agreement, state laws, and the circumstances of the accident. Generally, the driver of the rental car is responsible for any damages or injuries caused by their negligence, just as if they were driving their own vehicle.

However, liability can be complex because the rental company technically owns the vehicle. Some rental agreements include provisions that hold the renter responsible for damages, while others may offer limited liability protections.

According to an expert personal injury lawyer, liability could be shared or assigned based on fault, negligence, or contract terms. If another driver caused the accident, their insurance would typically be primary.

But if you were at fault, your insurance and the rental company’s policies come into play.

Does Your Personal Auto Insurance Cover Rental Cars?

Yes, most personal auto insurance policies do extend liability coverage to rental cars. This means if you cause an accident while driving a rental, your personal liability insurance usually covers injuries and damages to others.

However, there are important limitations to keep in mind:

- Your liability insurance covers third-party damages and injuries but typically does NOT cover damage to the rental car itself. You will be responsible for repair costs unless you have additional coverage.

- Some personal policies explicitly exclude rental cars or limit coverage, so it’s essential to verify with your insurer before renting.

- If you have purchased supplemental insurance from the rental company, that may become the primary coverage for damages, with your personal insurance acting as secondary.

Pro Tip: Be mindful of your personal insurance policy coverage. Take a photo of it or save a copy somewhere.

How Do I Know if my Personal Auto Policy Excludes Rental Vehicles?

To know if your personal auto insurance policy excludes rental cars, you should take these steps:

- Review Your Policy Documents: Look for sections mentioning "non-owned vehicles," "rental cars," or "temporary substitute vehicles." Some policies explicitly state whether coverage extends to rental vehicles and under what conditions. Pay attention to any exclusions related to rental cars, types of vehicles, or geographic limits.

- Check Coverage Types: Ensure your policy includes liability, collision, and comprehensive coverage. Many insurers only extend these coverages to rental cars if they apply to your personal vehicle. For example, if you lack collision coverage on your own car, your policy likely won’t cover damages to a rental car.

- Consider the Purpose of Use: Some policies exclude coverage if the rental car is used for business purposes rather than personal use. For example, if you rent a dry van trailer rental to transport goods or equipment for your business, your personal auto insurance likely will not cover you in case of an accident. According to Forbes, personal auto insurance generally does not cover rental vehicles used for business activities such as deliveries or client visits. In such cases, you would need a commercial auto insurance policy or specific business-use coverage to be protected.

- Contact Your Insurance Agent or Company: The most reliable way to confirm is to call your insurer or agent directly. Ask specifically if your personal auto policy covers rental cars, any duration limits, geographic restrictions, or exclusions for certain rental companies or vehicle types.

- Request Written Confirmation: For clarity and peace of mind, ask your insurer to provide written documentation or an endorsement confirming rental car coverage and any limitations.

For example, Nationwide advises calling your agent before renting to verify coverage, especially if you don’t have full liability, collision, and comprehensive coverage on your personal vehicle. Similarly, if your policy includes liability, comprehensive, and collision, you may not need extra rental insurance, but checking is essential.

Also, some insurers treat rentals from peer-to-peer platforms like Turo differently than traditional rental companies, sometimes requiring additional coverage or endorsements.

The key to knowing if your personal auto policy excludes rental cars is to carefully review your policy and confirm with your insurer to avoid unexpected gaps in coverage.

What Additional Insurance Options Are Available When Renting?

Rental companies offer several optional coverages to protect renters from out-of-pocket expenses:

- Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW): This waives your financial responsibility for damage to the rental car due to collision, theft, or vandalism. It is not technically insurance but a waiver that can save you from costly repairs.

- Supplemental Liability Insurance (SLI): Provides additional liability coverage beyond your personal policy, often up to $1 million. This protects you if you cause serious injury or property damage to others.

- Personal Accident Insurance (PAI): Covers medical expenses for you and passengers in case of injury during the rental.

- Personal Effects Coverage (PEC): Protects your belongings inside the rental car from theft.

Before declining these options, check if your personal auto insurance or credit card offers similar protections. Many credit cards include rental car insurance benefits, but coverage varies and often requires activation.

Who Pays for Damages and Injuries?

If you cause an accident in a rental car, the payment responsibility follows this general order:

- Rental Car Company’s Insurance or Waivers: If you purchased CDW/LDW or SLI, these policies may cover damages and liability first.

- Your Personal Auto Insurance: If you didn’t buy additional coverage, your personal liability insurance usually covers injuries and damages to others but not the rental car damage.

- You Personally: If neither the rental company’s coverage nor your insurance applies, you could be personally liable for all costs, including medical bills, property damage, and rental car repairs.

If you don’t have personal auto insurance, or your policy excludes rental cars, you face the risk of paying out-of-pocket for all damages.

Can You File a Personal Injury Lawsuit Against a Rental Car Company?

Filing a personal injury lawsuit against a rental company after an accident is uncommon and generally difficult. Rental companies are typically not liable for accidents caused by the renter’s negligence.

However, exceptions exist if:

- The rental vehicle was defective or poorly maintained, contributing to the accident.

- The rental company failed to disclose important safety information.

- The accident involved an employee driving the rental vehicle.

In most cases, your legal claim for injuries will be against the at-fault driver, which is usually you if you were driving the rental. Your personal injury lawsuit would target the responsible party’s insurance, which could be your own policy or another driver’s.

What Should You Do Immediately After a Rental Car Accident?

If you’re involved in an accident with a rental vehicle, follow these steps to protect yourself:

- Ensure Safety: Check for injuries and call emergency services if needed.

- Document the Scene: Take photos of damages, the accident scene, and any relevant road signs or signals.

- Exchange Information: Get contact and insurance details from other drivers and witnesses.

- Notify the Rental Company: Report the accident promptly as required by your rental agreement.

- Contact Your Insurance Company: Inform your insurer about the accident and provide all necessary documentation.

- Review Your Rental Agreement and Insurance Coverage: Understand your responsibilities and coverage limits.

- Consider Consulting a Personal Injury Lawyer: If injuries or disputes arise, legal advice can help you navigate claims and protect your rights.

Real-World Statistics and Insights

According to industry data, about 10-15% of rental car customers purchase additional insurance coverage at the counter, despite many having existing personal auto insurance or credit card benefits. This suggests a gap in understanding rental car insurance coverage.

Furthermore, rental car accidents account for a small but significant portion of car accidents annually. Handling claims involving rental vehicles can be more complex due to overlapping insurance policies and liability questions.

Experts recommend confirming your insurance coverage and credit card benefits before renting to avoid unexpected expenses and legal complications.

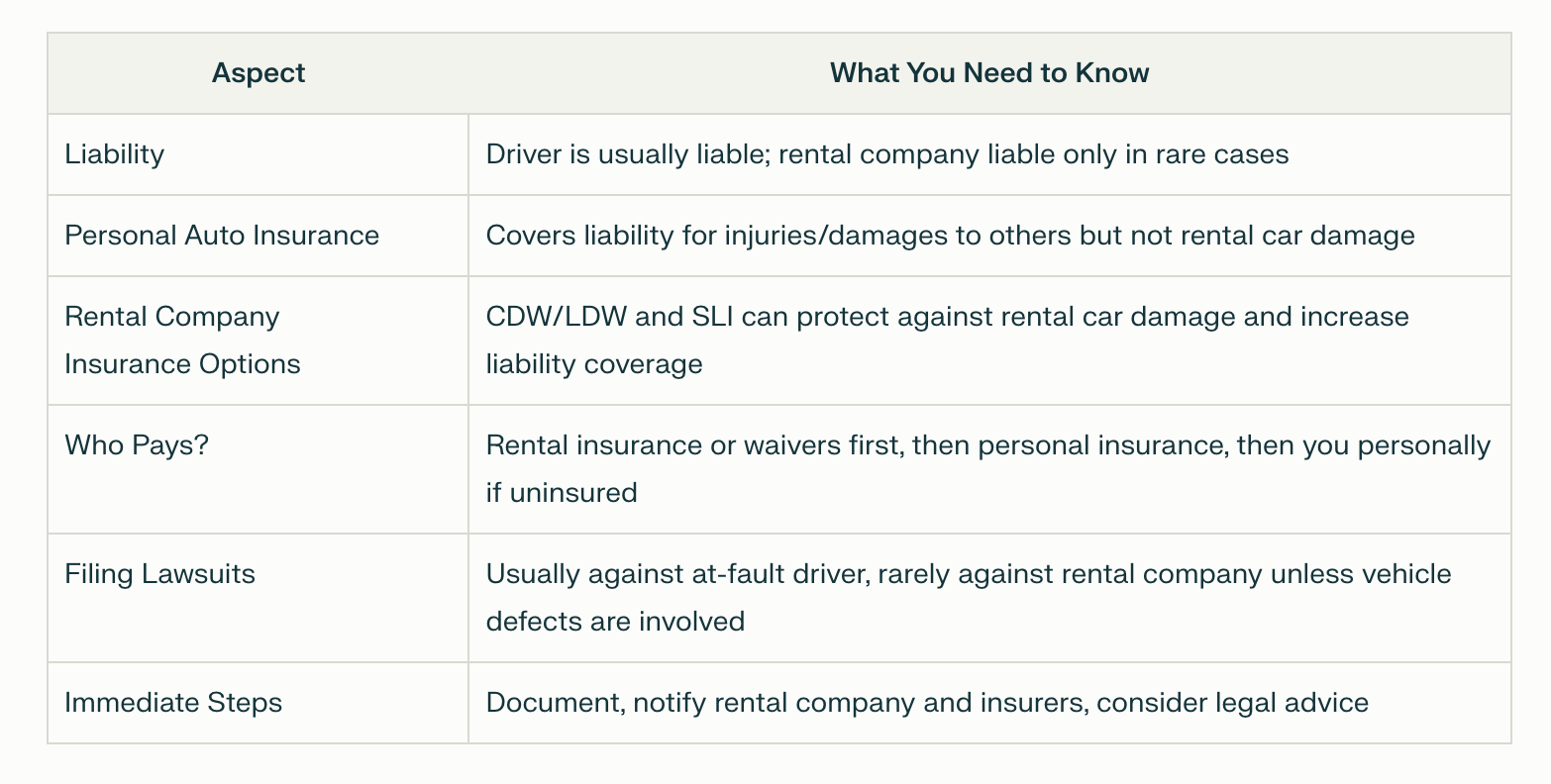

Summary: Key Takeaways for Rental Car Accident Situations

Final Thoughts

Accidents involving rental vehicles can be confusing and costly without the right knowledge. Understanding your insurance coverage, rental company policies, and legal rights is essential. Always verify your personal auto insurance and credit card benefits before renting, and consider purchasing additional coverage if needed.

If you face injury or liability disputes after a rental car accident, consulting a personal injury lawyer can help you protect your rights and navigate complex claims.